Consumer Advisory: Opportunity to cancel student loan debt ends soon

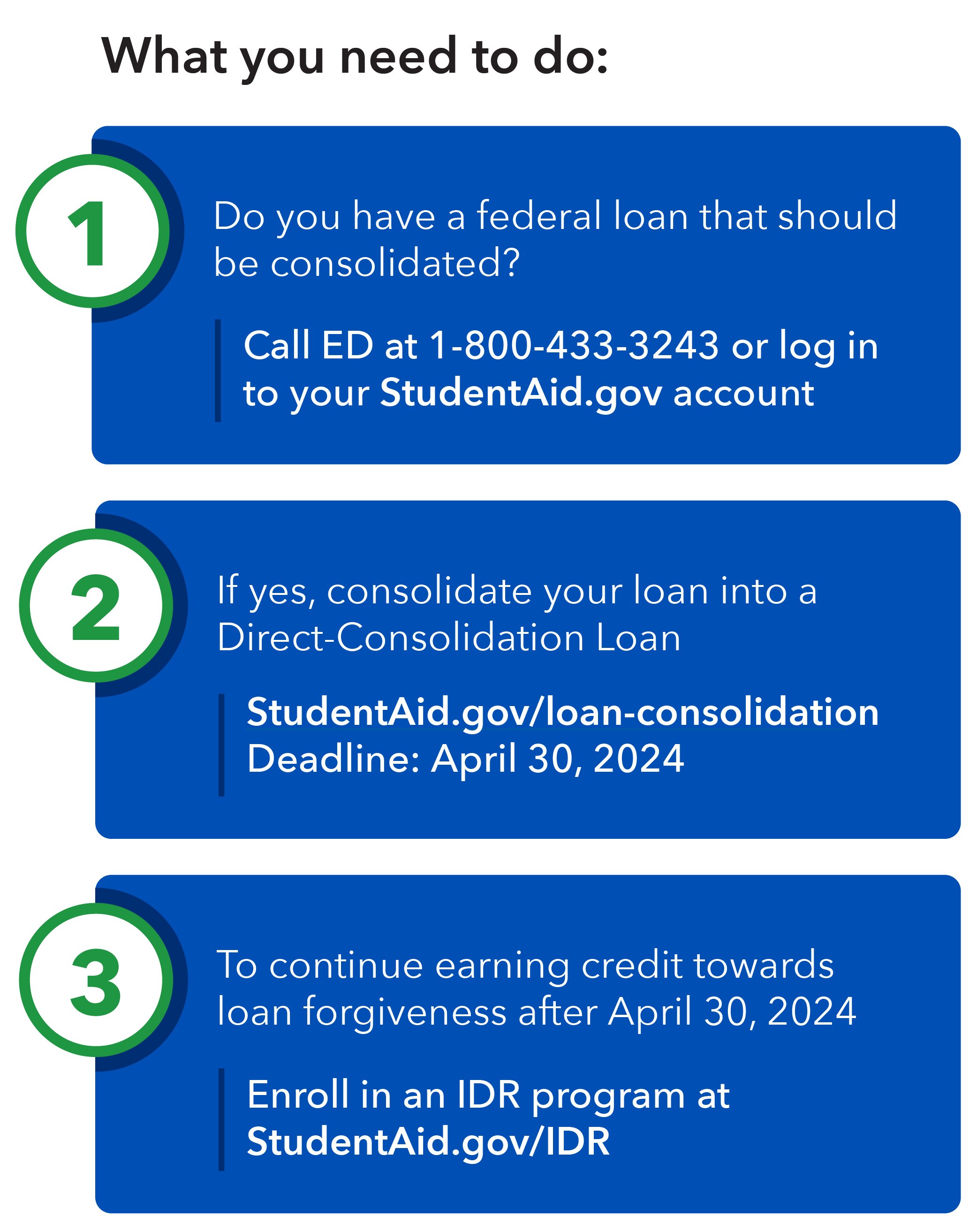

Many student loan borrowers have an opportunity to receive full student loan cancellation or more credit towards cancellation. The U.S. Department of Education will conduct a one-time adjustment this summer , but you may need to take steps to qualify.

The deadline to act is April 30, 2024. Here’s what you need to know.

Some borrowers need to consolidate their loans

To get the most credit toward loan cancelation, borrowers with the types of federally managed loans listed below must consolidate them:

- Commercially held Federal Family Education Loan (FFEL)

- Parent PLUS loans

- Perkins loans

- Health Education Assistance Loan (HEAL) Program loans

After you take this step, your new Debt Consolidation Loan is eligible for the one-time adjustment and more of the payments you have made up to this point will be counted toward loan cancellation.

Many borrowers could qualify to have student loans cancelled

The one-time adjustment is designed to count more of the payments you made, so they can be added to the payments required for cancellation. The Department of Education gives you credit towards loan cancellation through this adjustment if your loan is federally managed. The adjustment counts your loan payments made after July 1, 1994, and deferments, economic hardship, and forbearances, in some situations.

This means that through the adjustment you may be able to meet the cancellation requirements that is usually given to loans enrolled in an Income Driven Repayment program (IDR). Most federal student loans already qualify for at least one Income Driven Repayment (IDR) plan. Through an IDR, loans can be canceled after 10, 20, or 25 years of eligible payments. If you are seeking Public Service Loan Forgiveness (PSLF), these extra periods of payment count toward that program if you meet the other eligibility requirements. PSLF forgiveness can be received after 10 years of eligible payments.

Even if you don’t qualify for cancellation right now, an IDR program could help you lower your monthly payment. Through an IDR program, your monthly payment is based on your income and family size, not your loan balance. You can look into enrolling in an IDR program at any time.

Considerations for Parent PLUS borrowers

If you have a Parent PLUS loan managed by the Department of Education and at least 25 years – or 300 months – in repayment, your loan will be automatically cancelled through this one-time adjustment.

If you do not have 25 years in repayment, you should consolidate your Parent PLUS loan before the April 30th deadline to maximize the benefit.

Scammers charge you for doing what you can do for free

You don’t need to pay a fee to consolidate your loan, receive loan cancellation, or reduce your monthly payments. You can do it for free on the Department of Education’s website .

If you need help, contact your servicer, or use one of the resources listed below.

Where to get help

- Get more information about the one-time adjustment:

studentaid.gov/announcements-events/idr-account-adjustment - Learn about the benefits and disadvantages of consolidating a student loan:

studentaid.gov/help-center/answers/article/pros-and-cons-of-consolidation - Find more information about student loan cancellation:

studentaid.gov/manage-loans/forgiveness-cancellation - Learn how to enroll in an Income Driven Repayment Plan:

consumerfinance.gov/ask-cfpb/how-can-i-enroll-in-income-driven-repayment-en-2138/ - Get help filling out consolidation forms:

Call 1-800-4-FED-AID (433-3243) - If you have a problem with your student loan, you can submit a complaint to the CFPB:

consumerfinance.gov/complaint/